How bad is it for crypto?

The trial of former FTX founder and CEO Sam Bankman-Fried was never going to be great for the crypto industry, but just how big will its long-term impact be? Let’s take a Deep Dive.

⛓️ Sam Bankman-Fried, aka SBF, and others who worked for him are on trial in the US, following the spectacular collapse last year of FTX and Alameda Research, the crypto exchange and trading firm he founded.

⚖️ He and others stand accused of misappropriating customer funds from FTX to make personal investments and to prop up Alameda.

⏰ The trial has a while still to run and is set to be followed by another one in early 2024.

QUOTABLE

“I had a duty to all of our stakeholders, to our customers, to our creditors. I had a duty to our employees, to our investors and to the regulators of the world, to do right by them, to make sure that the right things happened at the company, and clearly, I didn’t do a good job of that.” - Sam Bankman-Fried, former FTX founder and CEO

BY THE NUMBERS

115 If SBF is convicted, he faces up to 115 years in jail.

50 FTX’s creditors include more than 50 entities in Hong Kong. Among them are government bodies, Hong Kong Monetary Authority and the Securities and Futures Commission.

50% Crypto liquidity dropped by 50 percent after FTX’s implosion, according to crypto data provider Kaiko, which refers to it as the Alameda Gap.

QUIZ

At its peak, how much was FTX worth?

A. $320 million

B. $3.2 billion

C. $32 billion

Scroll to the bottom for the answer.

DID YOU KNOW?

When corrupt bank BCCI collapsed in the late 1980s and early nineties, it caused extensive changes to banking regulations. Something analogous could happen now, a point made recently by US acting comptroller of the currency, Michael Hsu.

THE EDIT

💣 Bad business. The FTX collapse and the subsequent trial have had a startling range of negative impacts throughout the crypto industry.

🏛️ Wild wild west. FTX’s meltdown might lead to stricter crypto regulation in the US, with several agencies sniffing around.

💸 Funny money. SBF has been accused (he denies it) of withdrawing $684,000 in crypto through an exchange in the Seychelles while under house arrest.

⬇️ Surely there must be 12? Finding jurors for the FTX trial has been challenging because so many people said they knew someone who’d been stung by a failed crypto investment.

WATCH

Unsurprisingly, Sandra Ro, CEO of the Global Blockchain Business Council, thinks any problem here is with an individual bad actor and doesn’t reflect negatively on the industry as a whole.

THE FULL PICTURE

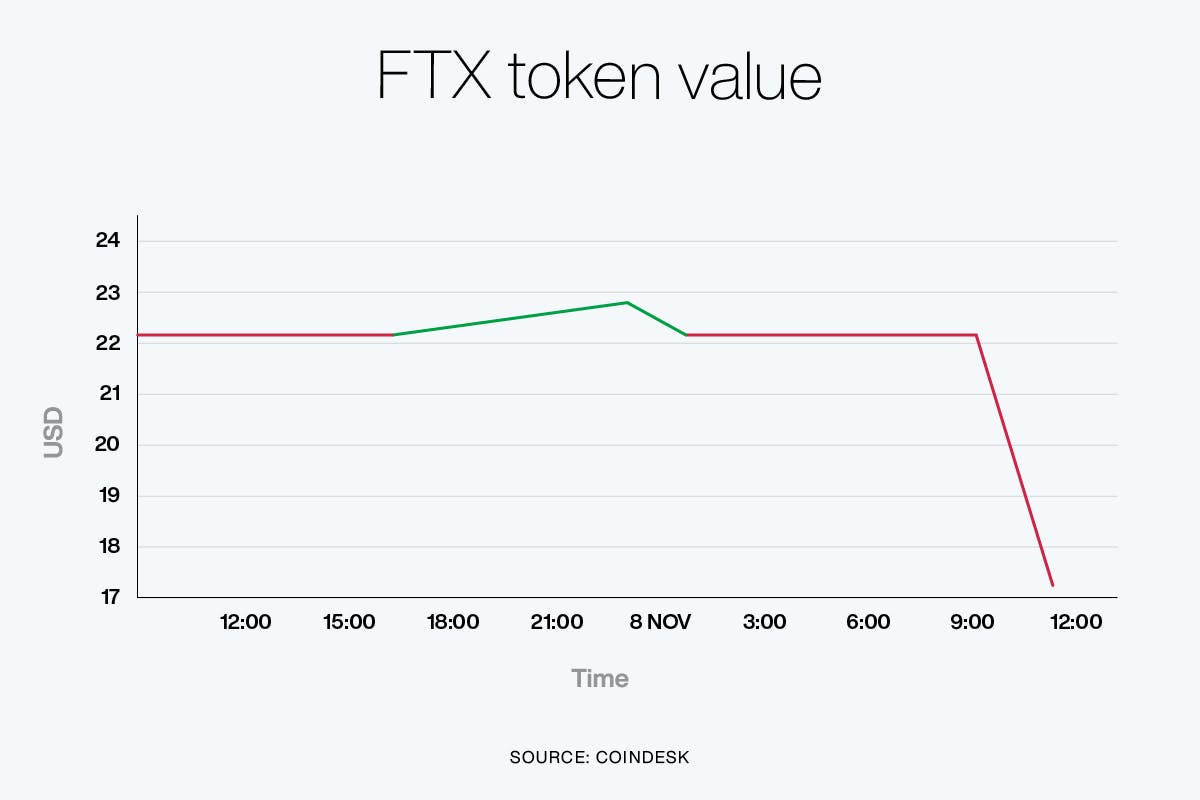

This is what happened to FTT in 24 hours, FTX’s own token, after things started to spiral out of control at the exchange in late 2022.

KEY PLAYER

Caroline Ellison

Alameda’s former CEO Caroline Ellison and SBF are in effect locked in a mutual blame game over who was responsible for FTX’s travails. Also the child of professor parents, in her case MIT economists, she was recruited by SBF to run Alameda after they met at Jane Street.

HONOUREE TO KNOW

Hsuan Lee

Portto and Blocto’s Hsuan Lee is democratising access to blockchain. His company Portto launched a zero fee crypto exchange in Taiwan, and is behind mobile blockchain wallet Blocto, which is aimed at people who aren’t fluent in the world of crypto, allowing them to easily access dapps. Its Series A funding round valued it at $80 million, with investors including Mark Cuban and 500 Global.

ONE FINAL THING

Before they moved to the Bahamas in 2021, where they were based in a $40 million penthouse and were planning to build offices designed to resemble SBF’s hair, FTX and its founder were based in Hong Kong. For someone theoretically worth billions, they were apparently based out of pleasant but not exactly lavish premises.